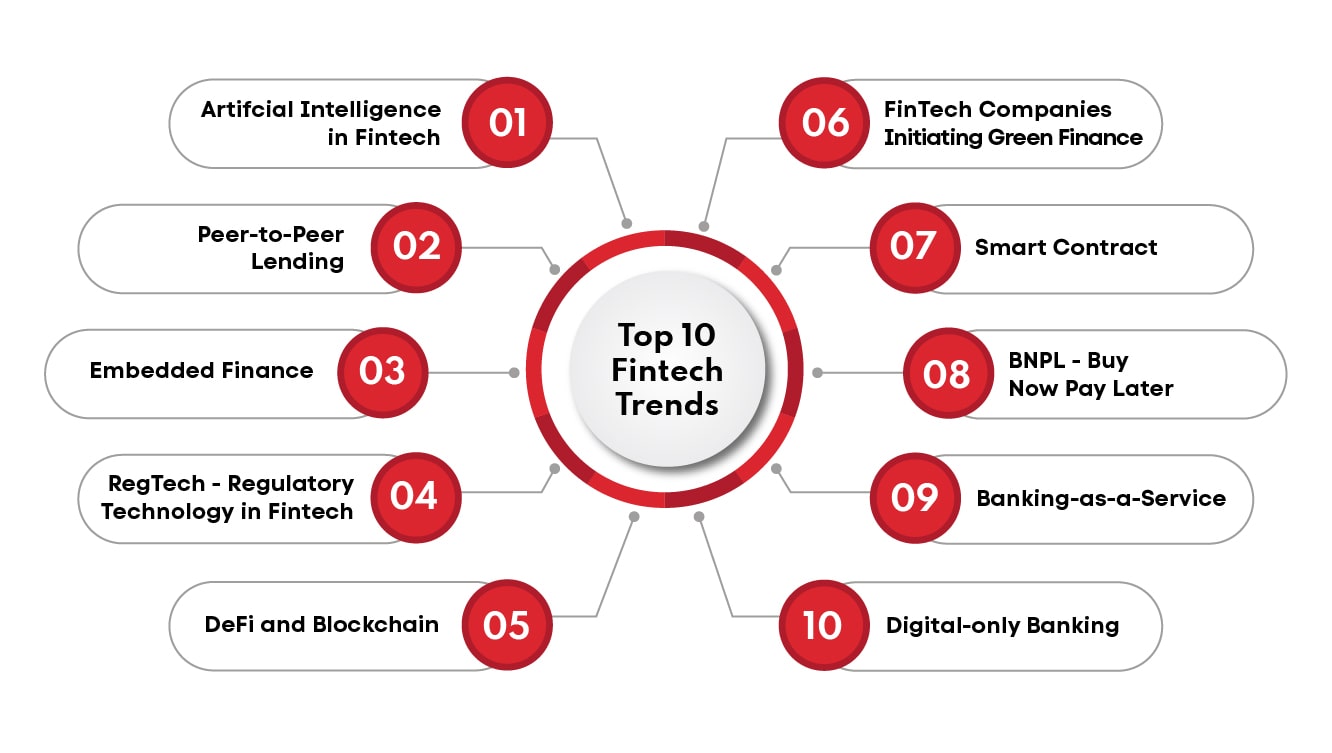

In 2024, fintech continues to reshape the financial landscape, with small businesses being key beneficiaries of this transformation. From access to innovative financing options to streamlined payment systems, fintech solutions offer affordable and efficient tools that empower small businesses to compete and thrive in a dynamic market. This article explores the top fintech trends in 2024 that are driving change for small businesses, with a particular focus on digital payments, AI-driven innovations, blockchain technology, and more.

1. Digital Payments: A Cornerstone of Small Business Growth

One of the most notable fintech trends for small businesses in 2024 is the continued growth of digital payments. With customers increasingly expecting fast and secure transaction options, digital payment solutions are no longer a luxury but a necessity for small businesses.

- Mobile Wallets and Contactless Payments: The use of mobile wallets such as Apple Pay, Google Pay, and Samsung Pay is becoming more widespread. These platforms allow customers to make quick, secure payments using their smartphones or smartwatches. For small businesses, adopting these technologies is crucial, as they provide seamless checkout experiences that reduce wait times and increase customer satisfaction【26†source】.

- Buy Now, Pay Later (BNPL): BNPL services have surged in popularity, particularly in sectors like retail and e-commerce. This payment model enables customers to split their payments into installments, increasing affordability and driving up average order values. For small businesses, integrating BNPL services can enhance sales conversion rates while providing a customer-friendly financing option【27†source】.

- Cross-Border Payments: Fintech platforms have made international trade more accessible to small businesses. Cross-border payment solutions like PayPal, Stripe, and TransferWise provide cost-effective, efficient ways to conduct international transactions. With currency conversion and minimal transfer fees, small businesses can now expand globally without facing prohibitive costs【25†source】.

2. AI-Powered Financial Management: Optimizing Small Business Operations

Artificial Intelligence (AI) is transforming the way small businesses handle financial management. In 2024, AI-driven fintech tools are providing smarter, faster, and more personalized financial services, reducing the administrative burden on small business owners.

- Automated Accounting and Bookkeeping: Fintech platforms like QuickBooks and Xero use AI to automate tasks such as invoicing, expense tracking, and financial reporting. These tools allow small business owners to maintain accurate financial records with minimal manual input, freeing up time for strategic business activities【27†source】.

- AI-Powered Risk Assessment: For small businesses seeking financing, AI is revolutionizing the underwriting process. By analyzing large datasets, AI algorithms can assess creditworthiness in real-time, providing businesses with faster loan approvals and more tailored financing options. This trend is particularly valuable for startups or businesses with limited credit history, as alternative data points such as payment history or social media activity can now be considered in loan decisions【26†source】【25†source】.

- Chatbots and Customer Support: AI chatbots are enhancing customer service for small businesses by handling routine inquiries and transactions. Fintech platforms offering chatbot solutions enable small businesses to provide 24/7 customer support without the need for extensive staffing【27†source】.

3. Blockchain Technology: Revolutionizing Transparency and Security

Blockchain, once seen as a niche technology, has evolved into a mainstream solution for enhancing transparency, security, and efficiency in financial transactions. For small businesses, blockchain presents a range of applications that can streamline operations and improve trust.

- Smart Contracts: One of the most promising blockchain innovations is the rise of smart contracts. These self-executing contracts automatically trigger payments or other actions when predefined conditions are met, reducing the need for intermediaries. For small businesses, smart contracts offer a way to automate agreements with suppliers, customers, or freelancers, ensuring timely payments and reducing the risk of disputes【26†source】.

- Supply Chain Transparency: Blockchain’s ability to record immutable transactions is being used to enhance transparency in supply chains. For small businesses that rely on multiple suppliers, blockchain can provide real-time visibility into the movement of goods, ensuring authenticity and reducing the risk of fraud【25†source】.

- Cryptocurrency Payments: While cryptocurrency adoption is still in its early stages, an increasing number of small businesses are exploring crypto payments as a way to cater to tech-savvy customers. Platforms like BitPay and Coinbase Commerce are making it easier for small businesses to accept Bitcoin, Ethereum, and other digital currencies, offering an additional payment option while minimizing transaction fees【25†source】.

4. Open Banking: Fostering Collaboration and Innovation

Open banking is an emerging trend that encourages financial institutions to share customer data (with their consent) with third-party fintech providers. This framework is creating new opportunities for small businesses by providing them with access to a broader range of financial products and services.

- Aggregated Financial Services: Open banking enables small businesses to connect their bank accounts with multiple fintech platforms, allowing for more comprehensive financial management. With aggregated data, small businesses can track cash flow, manage expenses, and receive real-time insights into their financial health—all from a single dashboard【26†source】【27†source】.

- Tailored Financial Products: Through open banking, fintech companies can offer small businesses more personalized products such as loans, credit lines, and insurance. By accessing a business’s financial data, fintech providers can assess risk more accurately and provide tailored solutions at competitive rates【26†source】.

- Enhanced Cash Flow Management: Cash flow is the lifeblood of small businesses, and open banking allows for better cash flow forecasting and management. By leveraging AI-powered fintech tools, small businesses can automate payments, optimize working capital, and avoid overdrafts, ensuring financial stability【27†source】.

5. Alternative Financing: Expanding Access to Capital

Access to capital remains a top concern for small businesses, and fintech innovations are breaking down traditional barriers to financing. In 2024, small businesses have more alternative financing options than ever before.

- Peer-to-Peer Lending: P2P lending platforms like Funding Circle and LendingClub are offering small businesses easier access to loans by connecting them with individual or institutional lenders. These platforms provide flexible financing options with lower interest rates compared to traditional banks【26†source】.

- Revenue-Based Financing: A growing number of fintech companies are offering revenue-based financing, where repayments are tied to a percentage of monthly revenue rather than fixed payments. This model is particularly attractive to small businesses with fluctuating cash flow, such as seasonal businesses【25†source】.

- Equity Crowdfunding: Crowdfunding platforms like Seedrs and StartEngine allow small businesses to raise capital by selling equity to a large pool of investors. This approach not only provides access to funding but also helps businesses build a community of brand advocates【25†source】.

6. Regtech: Streamlining Compliance for Small Businesses

Regtech (regulatory technology) is becoming increasingly important for small businesses as regulatory requirements become more complex. Fintech companies offering regtech solutions are helping small businesses stay compliant with industry regulations while reducing administrative overhead.

- Automated Compliance Tools: Regtech solutions can automate compliance processes, such as anti-money laundering (AML) checks and Know Your Customer (KYC) verifications. For small businesses, this reduces the time and cost associated with manual compliance checks【25†source】【27†source】.

- Real-Time Monitoring: Fintech platforms now offer real-time monitoring tools that help small businesses detect potential compliance issues before they escalate. These tools are particularly useful in highly regulated industries, such as finance and healthcare【26†source】.

Conclusion: A Bright Future for Small Businesses in 2024

The fintech landscape in 2024 is full of opportunities for small businesses. From digital payments and AI-powered financial management to blockchain and open banking, the innovations driving the fintech sector are making it easier for small businesses to access affordable, efficient financial services. By embracing these trends, small businesses can optimize their operations, enhance customer experiences, and position themselves for growth in an increasingly digital world.

As these fintech innovations continue to evolve, small businesses that adopt and integrate these tools will be better equipped to navigate financial challenges, expand their market reach, and stay competitive in the fast-changing global economy.